Judul : Korea's Central Bank Chief Triggers Bond Market Chaos

link : Korea's Central Bank Chief Triggers Bond Market Chaos

Korea's Central Bank Chief Triggers Bond Market Chaos

According to Citigroup, we believe the Bank of Korea's rate reductions have already finished at an annual rate of 2.5%,

"There were numerous indications that interest rate reductions might not occur, but Governor Rhee Chang-yong firmly established a clear stance, signaling that the cycle of rate cuts has concluded," (A Bank bond dealer)

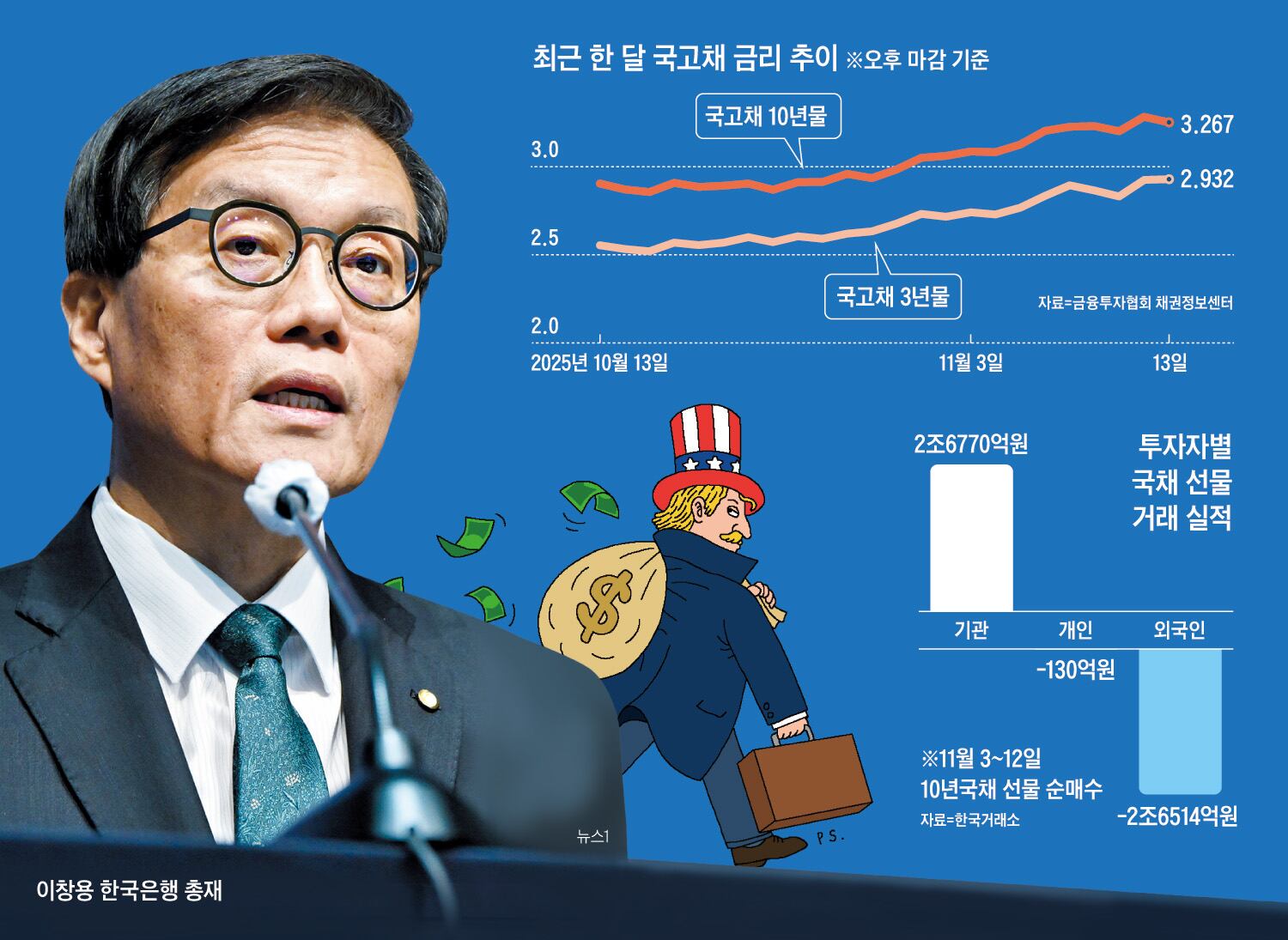

Foreign investors are withdrawing from the South Korean bond market. As reported by the Korea Exchange on the 13th, foreign entities have net-sold more than 2.65 trillion Korean won in 10-year government bond futures this month. On the 12th, the 10-year yield reached 3.3% during the day and closed at 3.282% annually, setting a new yearly peak. This marked the first time the yield exceeded the 3.3% level since July of the previous year. The 5-year yield also increased by 0.1 percentage points in one day, while the 3-year yield, which had risen almost 0.4 percentage points over the past month, ended at 2.923% on the 12th, breaking its annual record.

The sudden increase in government bond yields during the last month, which "stalled" again on the 12th, was impacted by Bank of Korea Governor Rhee Chang-yong. In a Bloomberg TV interview released on the 12th, Governor Rhee mentioned, "The official monetary policy approach of the BOK is currently a rate reduction phase. However, the extent, timing, or even a shift in the direction of rate cuts may differ based on new data."

The market concentrated on the phrase "change in direction." This was understood to imply not just an end to rate reductions, but also the potential for moving towards rate increases based on economic data. Some analyses suggest that this statement surprised the market by removing expectations of further rate cuts.

Foreign investors sold 1.5352 trillion won in 3-year bond futures and 427.9 billion won in 10-year bond futures on that day, causing bond yields to rise. Part of the money from these bond sales was converted into dollars, further increasing pressure on the won-dollar exchange rate.

As the market experienced fluctuations, Park Jong-woo, a senior BOK official, clarified by saying, “Governor Rhee’s comments do not suggest a change in monetary policy or any contemplation of interest rate increases.” The Ministry of Economy and Finance also noted, “We are closely watching the sharp rise in government bond yields,” and rushed to address the consequences.

The local bond market is already showing signs of concern because of increasing supply pressures. The government's budget for next year is a record 728 trillion won. As a result, the amount of government bonds to be issued next year is expected to increase by 12% compared to this year, reaching 232 trillion won, which is also a record high. Out of this, deficit bonds, excluding redemptions, total 110 trillion won.

Alongside this are the challenges of issuing bonds to raise funds for annual outflows of $200 billion in investments to the U.S. and the expanded 150 trillion won National Growth Fund. Higher bond issuance results in an increased supply of bonds in the market, causing bond prices to decline (and yields to rise). Yoon Yeo-sam, a researcher at Meritz Securities, stated, “The burden of bond supply is inevitably increasing due to higher government bond issuance and quasi-fiscal bonds such as the National Growth Fund.”

Several people in the market believe that Governor Rhee's statements created unnecessary turbulence during a delicate period. A research study led by Cho Du-yeon, a professor at Sungkyunkwan University, examined how comments from four BOK governors—Lee Sang-tae, Kim Choong-soo, Lee Ju-yeol, and Rhee Chang-yong—affected financial markets. The findings indicated that Governor Rhee's straightforward approach during press conferences led to the greatest fluctuations in the bond market.

A specialist in the domestic bond market stated, “Governor Rhee's comments were not just a blow when someone was on the verge of tears, but a strike when they were already crying,” and noted, “It had a negative impact on market confidence during a period of increased bond market volatility.”

Demikianlah Artikel Korea's Central Bank Chief Triggers Bond Market Chaos

Anda sekarang membaca artikel Korea's Central Bank Chief Triggers Bond Market Chaos dengan alamat link https://www.arablionz.pro/2025/11/koreas-central-bank-chief-triggers-bond.html

0 Response to "Korea's Central Bank Chief Triggers Bond Market Chaos"

Posting Komentar