Judul : Rachel Reeves faces fresh setback as government debt surges before Budget announcement

link : Rachel Reeves faces fresh setback as government debt surges before Budget announcement

Rachel Reeves faces fresh setback as government debt surges before Budget announcement

Rachel Reeveshas faced a new setback before next week'sBudgetas the most recent data indicated increased government borrowing compared to expectations for the previous month.

The Chancellor was encouraged to impose stricter control over expenditures following the Office for National Statistics (ONS) disclosed that public sector borrowing reached £17.4 billion in October.

This was £1.8 billion less compared to the previous year, yet it remained the third highest figure for October since records started.

The amount was also greater than the £15 billion anticipated by most economists and exceeded the £14.4 billion prediction from the Office for Budget Responsibility (OBR) oversight body.

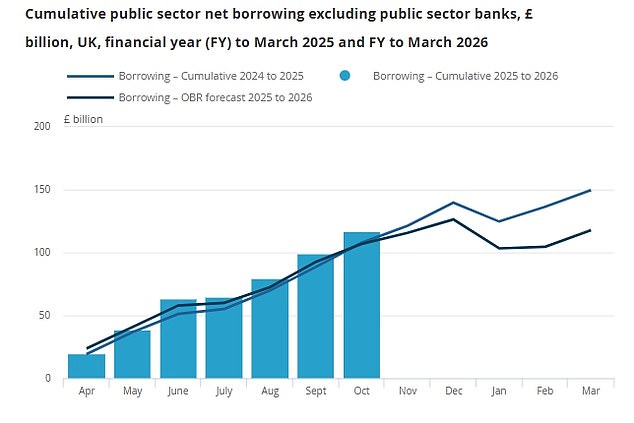

Total loans taken during the current financial year amounted to £116.8 billion — approximately £9 billion more than the same period last year and £9.9 billion exceeding the OBR's projections from March.

It occurs less than a week before Ms. Reeves' Budget on 26 November, with reports suggesting she is expected to confront a multi-billion pound shortfall in public finances.

Although there was a sudden change in plans to increase income tax, the Chancellor is still anticipated to introduce a variety of new taxes in an effort to generate revenue.

However, the Conservatives urged her to concentrate on managing government expenditures in an effort to prevent additional tax burdens for British citizens.

Shadow chancellor Sir Mel Stride stated: "The amount borrowed this year has reached the highest level ever recorded outside of the pandemic period."

If the Labour party possessed any strength, they would manage expenditures to prevent tax increases next week.

While Labour intends to increase spending further, the Conservatives aim to reduce the deficit and lower taxes by following our golden economic principle and our £47 billion savings strategy.

Nick Ridpath, an economist from the Institute for Fiscal Studies think tank, recommended that the Chancellor provide herself with a larger cushion in relation to her fiscal guidelines during the Budget.

"The current data indicates that the Government's borrowing has remained above the OBR's projection for the year so far, amounting to approximately £10 billion," he stated.

This excess is caused by a mix of lower-than-anticipated tax revenues and increased borrowing from councils and other entities not under central government authority.

What this emphasizes is that predictions regarding the amount of borrowing this year are open to significant uncertainty, let alone those for borrowing in four or five years.

Functioning with a very small financial buffer is dangerous, and this is one reason why the Chancellor could reasonably aim to expand her so-called 'fiscal flexibility' during next week's Budget.

Liberal Democrat MP Daisy Cooper, who serves as the party's Treasury representative, stated: 'This is another indication that the Government is not managing to improve the situation - they have no defined plan for our economy.'

At the Budget, we require a solid strategy to initiate growth, beginning with a new UK-EU customs union.

More troubling news for Ms. Reeves came on Friday, with retail sales revealing an unexpected decline last month—the first such drop since May.

The most recent indication of consumer hesitation before the Budget revealed that official data indicated a 1.1 percent decline in retail sales volume during October.

This came after an upwardly adjusted rise of 0.7 percent in September.

Many economists had predicted that retail sales would stay the same from one month to the next in October.

Over the three months ending in October, the ONS reported that retail sales increased by 1.1 percent from the prior three-month period, with rises in August and September counterbalancing the drop recorded in the previous month.

The numbers come after a series of retailers stated that consumer spending has decreased because of uncertainty regarding the Budget, including the well-known high street brand Marks & Spencer.

And separate findings from GfK on Friday indicated that consumer confidence has declined across all indicators this month, with the public described as "preparing for tough news."

Treasury minister James Murray stated that next week's Budget will outline Ms Reeves' plans to 'reduce debt'.

He stated: "At present, we allocate £1 out of every £10 of taxpayer funds towards the interest on our national debt."

That funds ought to be directed towards our schools, hospitals, police department, and military.

That's why we are poised to achieve the biggest reduction in the primary deficit within both the G7 and G20 during the next five years – in order to lower borrowing costs.

The official statistics indicated that public sector borrowing was reduced by £400 million for the first six months of the fiscal year.

ONS chief economist Grant Fitzner stated: "Lending in October decreased compared to the same month in the previous year, yet it remained the third-largest October amount ever recorded in nominal terms."

Although expenditure on public services and benefits rose in October last year, this was largely balanced by higher income from taxes and National Insurance payments.

Read more- How did Chancellor Rachel Reeves manage to record the smallest government borrowing in three years, and what implications does this have for her upcoming Budget?

- Why is Rachel Reeves encountering a financial challenge as borrowing reaches post-pandemic peaks ahead of her crucial Budget announcement next week?

- How is Rachel Reeves addressing the growing financial crisis as debt increases more than anticipated?

- With increasing debt challenges, is Rachel Reeves caught between reducing expenditures and raising taxes to sustain the economy?

- What could compel Chancellor Rachel Reeves to make a difficult choice regarding rising UK borrowing expenses and possible tax increases this autumn?

Demikianlah Artikel Rachel Reeves faces fresh setback as government debt surges before Budget announcement

Anda sekarang membaca artikel Rachel Reeves faces fresh setback as government debt surges before Budget announcement dengan alamat link https://www.arablionz.pro/2025/11/rachel-reeves-faces-fresh-setback-as.html

0 Response to "Rachel Reeves faces fresh setback as government debt surges before Budget announcement"

Posting Komentar